Real estate is local—and so are the laws.

Some states make it easier to be a landlord. Others don’t.

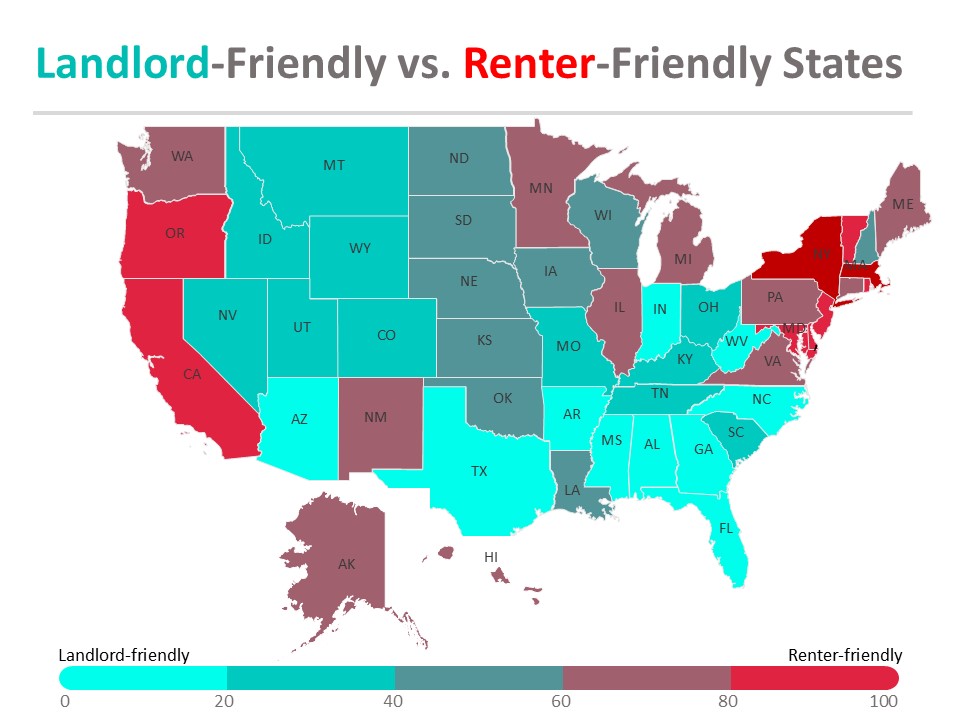

Most real estate investors focus on purchase price, rent, and rehab costs—but state policy can quietly shape your returns.

Laws around evictions, rent control, and property rights have a direct impact on your cash flow and risk profile.

In landlord-friendly states, investors can move faster, enforce leases, and protect capital with fewer regulatory barriers. In renter-friendly states, slow processes and added restrictions can quietly eat into returns and increase long-term risk.

What Is a Landlord-Friendly State?

- Allows faster evictions for non-payment

- Has no rent control

- Offers clear legal protections for landlords

- Favorable court interpretations for property owners

What Is a Renter-Friendly State?

- Long eviction moratoriums or complex court procedures

- Rent control laws that cap increases or require approvals

- Strict limits on screening or security deposits

- Mandatory lease renewals or “just cause” eviction rules

- Legal precedent that heavily favors tenants in disputes

Final Thought

Choosing to invest in a landlord-friendly state can mean faster evictions, fewer regulatory hurdles, and stronger protections for your capital. Renter-friendly states may offer growing populations and rising rents, but often come with slower processes and added risk.

Smart investors weigh policy just as carefully as price—because the law affects the bottom line.