Cap rate is easy to learn—and even easier to get wrong

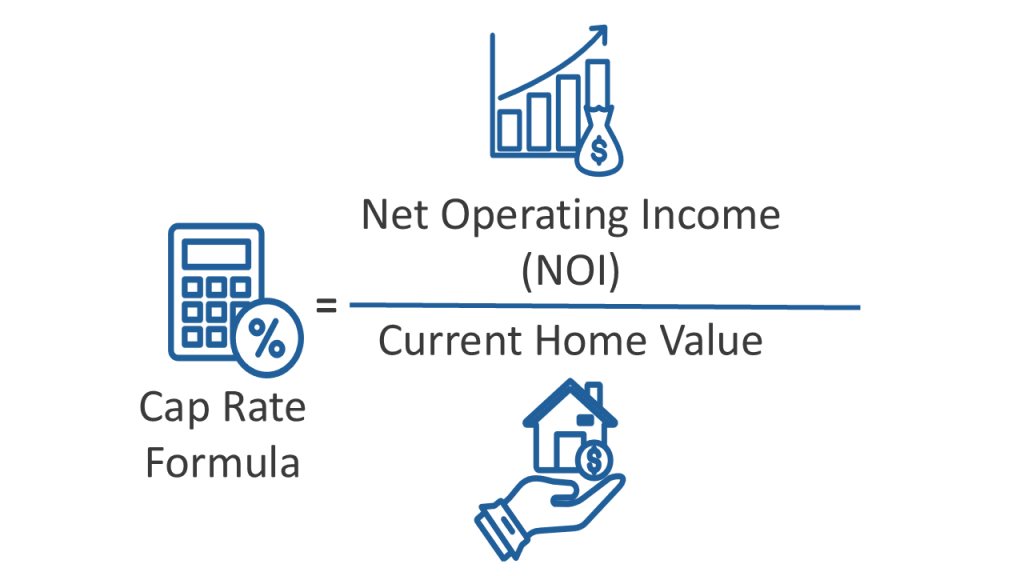

Cap Rate measures a property’s return based on income generated before financing.

Yield-on-Cost measures a property’s return based on income generated after financing.

Let’s say a property generates $40,000 in Net Operating Income (NOI) and is purchased for $500,000:

This means it’s producing an 8% yield on the purchase price.

What Cap Rate Tells You

- A benchmark for comparing similar properties in the same market

- A gauge for risk—higher cap rates often signal higher risk

- A metric for valuing income-producing properties

In general:

- Lower cap rates = stronger, more stable markets (lower risk, higher price)

- Higher cap rates = secondary or emerging markets (higher risk, lower price)

What Cap Rate Doesn’t Tell You

Cap rate is useful—but limited. It doesn’t account for:

- Debt serivce or financing

- Renovation or capital expenditures

- Tax strategy

- Future income growth or lease-up risk

- Resale value or appreciation

When to Use Cap Rate

Cap rate is best used for:

- Initial screening of potential acquisitions

- Comparing properties in similar markets

- Rough valuation of income-producing assets

Cap rate is less effective for:

- Value-add or renovation projects

- Deals with heavy leverage or irregular income

- In-depth financial modeling or return projections

Cap rate shows what the property earns. Yield-on-Cost shows you yield after debt servicing.

Final Thought

Cap rate is a helpful tool, but not a complete picture. It should be viewed as one data point among many—alongside metrics like yield-on-cost, IRR, and equity multiple.

While cap rate doesn’t account for financing, strategic use of leverage can meaningfully enhance returns when used responsibly. Smart underwriting paired with the right debt structure can turn a good deal into a great one.

Smart investors use cap rate to start the conversation, not to end it.